Economics 391: Economics and Business Statistics, fall 2012

Instructor: Prof. Jeremy A. Sandford

Office hour: TR 3-4pm, 335L B&E, or by appointment

Lecture:

9:30-10:45am TH, BE 206

Exam dates:

Tuesday, September 25 and Thursday, October 25, in class

Final exam

date: Tuesday, December 11, 8am-10am

Required texts: Keller, Statistics, South-Western College Pub

Homework 1, answers

Homework 2, answers

Homework 3, answers

Homework 4, answers

Homework 5, not collected

(final exam prep)

Schedule

Thursday, August 23: Basic probability

reading: Keller, chapter 6

reading: The probability of injustice, The Economist,

1/22/2004

Tuesday, August 28: Conditional probability, random

variables, mean and variance, binomial distribution

reading: Keller, chapters 6-7

reading: LA Times article on mammogram

guidelines (referenced in class in discussion about false positives and

conditional probabilitites)

Thursday, August 30: Binomial, Poisson, and uniform random

variables, probability calculations in Excel

reading: Keller, chapters 7-8

Tuesday, September 4: Exponential and normal random

variables

reading: Keller, chapter 8

reading: What fraction of

7-footers are in the NBA

Thursday, September 6: Standardizing normal random

variables, using normal probability tables

reading: Keller, chapter 8

Tuesday, September 11: Sampling distributions

reading: Keller, chapter 9

Thursday, September 13: Sampling distributions of means and

propostions, several example problems

reading: Keller, chapter 9

Tuesday, September 18: Estimation, confidence intervals for

means

reading: Keller, chapter 10

Thursday, September 20: Exam review

Tuesday, September 25: Midterm 1 (with

answers)

grade distribution

Thursday, September 27: Hypothesis tests, type I and type

II error

reading: Keller, chapter 11

Tuesday, October 2: Introduction to hypothesis tests,

type I and type II errors

reading: Keller, chapter 11

Thursday, October 4: Two-tailed hypothesis tests, p-values

reading: Keller, chapter 11

Tuesday, October 9: Calculating the probability of type II

error, example problems

reading: Keller, chapter 11

Thursday, October 11: Introduction to regression analysis

reading: Keller, chapter 16

Tuesday, October 16: T-distribution, examples of regression

in Excel

reading: Keller, chapter 16

ANES2008 data set

GSS2008 data set

Thursday, October 18: Multiple regression, example of

getting and using iPums data

reading: Keller, chapter 17

Tuesday, October 23: Midterm II review

Thursday, October 25: Midterm II (with answers)

grade distribution

Tuesday, October 30: Multiple regression: correlation versus

causation, the importance of control variables

reading:

Levitt, S. (2003) "Prison conditions, captial punishment, and

deterrence", American Law and Economics review, 5.2, pp. 318-343

Keller, chapter 17

Thursday, November 1: Multiple regression:

multicollinearity, dummy variables and non-linear relationships

reading: Keller, chapter 18

Tuesday, November 6: No class (election day)

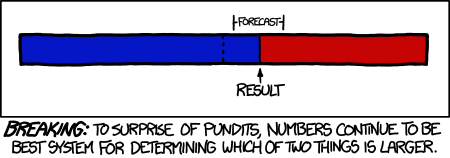

Thursday, November 8: data versus hunches in the 2012

election, the relationship between college football games and crime

reading: College Football Games and Crime, Journal of Sports

Economics, vol 10, no. 1, 2009

Tuesday, November 13: Discrimination on Weakest Link

reading: Testing theories of discrimination: Evidence from Weakest

Link, Steven Levitt, 2004, Journal of Law and Economics

Thursday, November 15: Simpsons's paradox, lying with

statistics

reading: (Dis)aggregation and

Simpson's paradox

Examples of dubious statistical

claims

Momentous spring at the 2156 Olympics?, Tatem et al.,

Nature 431 (525), September 30, 2004,

Tuesday, November 20: No class

Thursday, November 22: No class

Tuesday, November 27: Lying with statistics

reading: slides from class,

with explanations

Thursday, November 29: Capital asset pricing model (CAPM)

reading: Sandholm and Saranti,

Chapter 3, The Capital Asset Pricing Model

Two assets spreadsheet

Three assets spreadsheet

Tuesday, December 4: Capital asset pricing model (CAPM)

reading: Sandholm and Saranti,

Chapter 3, The Capital Asset Pricing Model

Two assets spreadsheet

Three assets spreadsheet

Thursday, December 6: Capital asset pricing model (CAPM)

reading: Sandholm and Saranti,

Chapter 3, The Capital Asset Pricing Model

Two assets spreadsheet

Three assets spreadsheet

Three risky assets and one

safe asset

Tuesday, December 11, 8am: Final exam